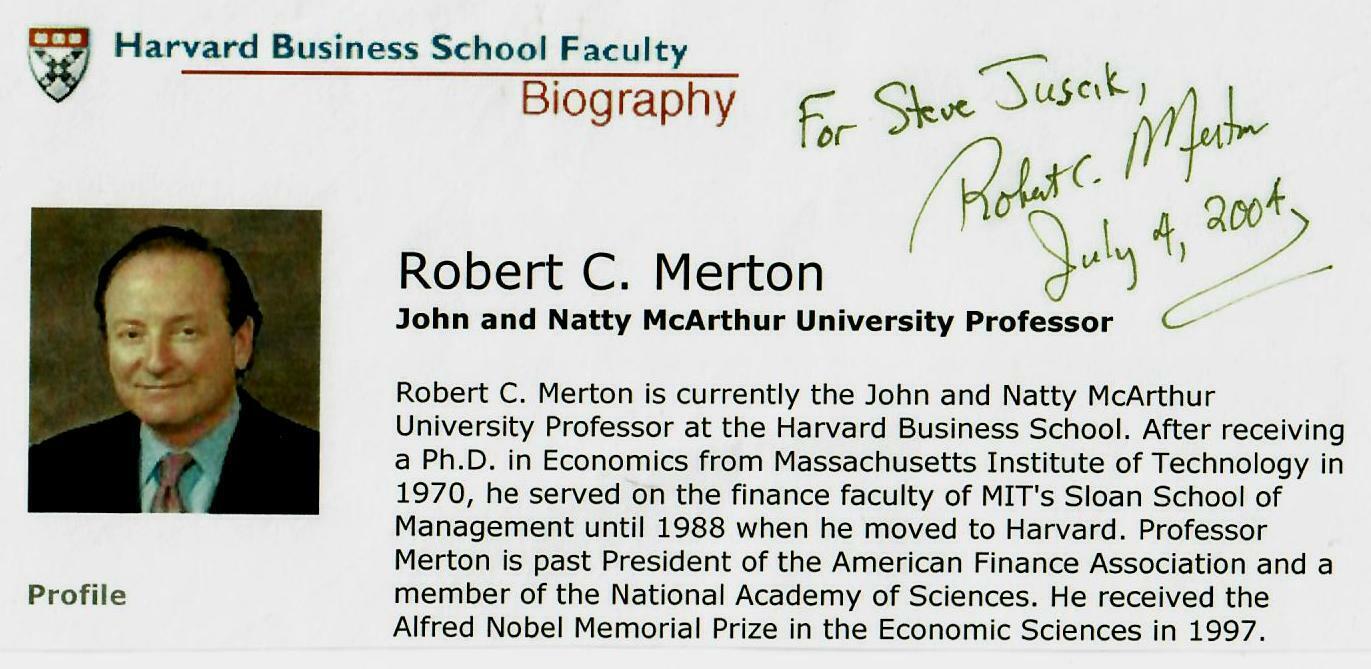

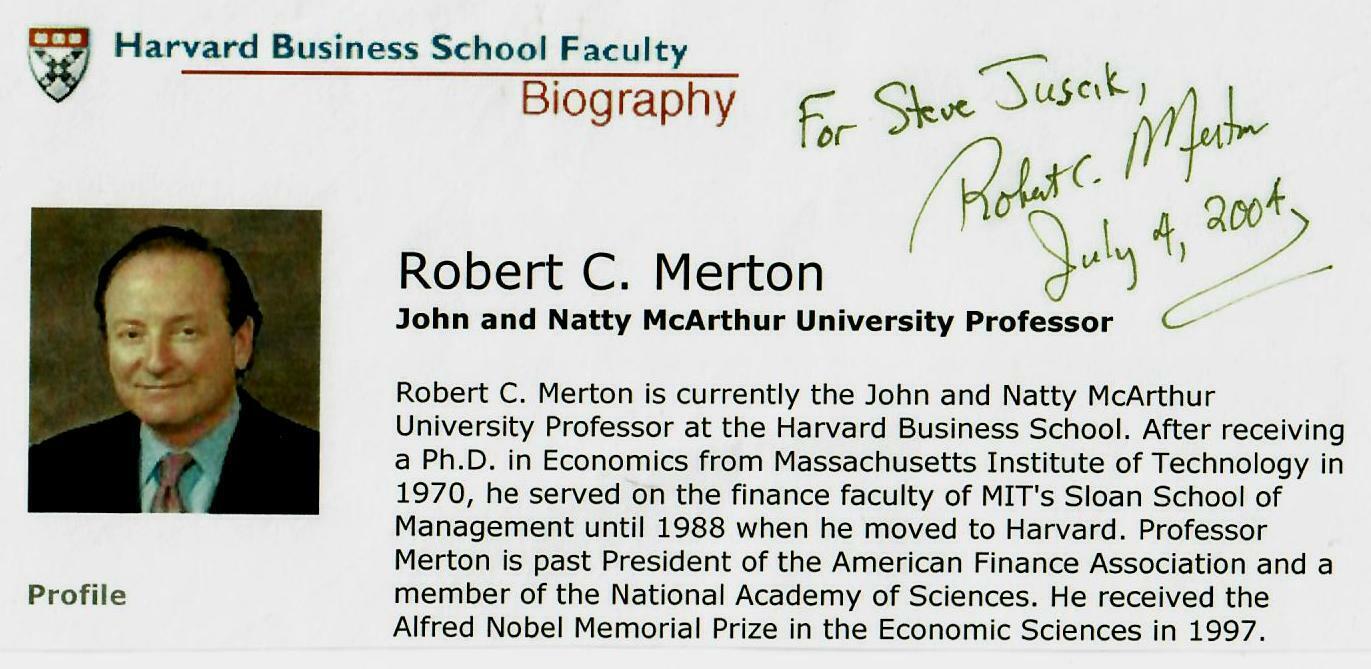

\"Nobel Prize In Economics\" Robert Merton Hand Signed Biography COA For Sale

When you click on links to various merchants on this site and make a purchase, this can result in this site earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network.

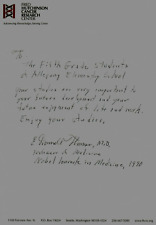

\"Nobel Prize In Economics\" Robert Merton Hand Signed Biography COA:

$104.99

Up for sale\"Nobel Prize In Economics\" Robert Merton Hand Signed Biography.This item is certified authentic by ToddMueller Autographs and comes with their Certificate of Authenticity. ES - 8120 RobertCox Merton(born July 31,1944) is an Americaneconomist,NobelMemorial Prize in Economic Scienceslaureate, and professor attheMIT Sloan School ofManagement, known for his pioneering contributions tocontinuous-time finance, especially the first continuous-time option pricingmodel, theBlack–Scholes–Merton model.In 1993 Merton co-founded hedge fundLong-Term CapitalManagement. In 1997 Merton Together withMyron Scholeswere awarded theNobel Memorial Prize in Economic Sciencesfor a method todetermine the value ofderivatives. Merton wasborn inNew York CitytoaJewishfather sociologistRobert K. Mertonand mother Suzanne Carhart who was froma \"multigenerational southern New Jersey Methodist/Quaker family.\"He grew up inHastings-on-Hudson, NY. Heearned a Bachelor of Science in Engineering Mathematics from theSchool of Engineering and Applied ScienceofColumbia University, aMasters of Science from theCalifornia Institute ofTechnology, and his doctorate in economics from theMassachusettsInstitute of Technologyin 1970 under the guidance ofPaul Anthony Samuelson. Hethen joined the faculty of theMIT Sloan School ofManagement, where he taught until 1988.Subsequently, Merton moved toHarvard University, wherehe was George Fisher Baker Professor of Business Administration from 1988 to1998. He was the John and Natty McArthur University Professor from 1998-2010.He rejoined the MIT Sloan School of Management in 2010 when he went Emeritus. RobertC. Merton is the School of Management Distinguished Professor of Finance at theMIT Sloan School of Management. He is Resident Scientist atDimensional Fund Advisors,where he developed a next-generation integrated pension-management solutionsystem that addresses deficiencies associated with traditional defined-benefitand defined-contribution plans. Merton is University Professor Emeritus atHarvard University. He was the George Fisher Baker Professor of BusinessAdministration (1988–98) and John and Natty McArthur University Professor(1998–2010) at the Harvard Business School. He previously served on the financefaculty of the Sloan School from 1970 until 1988. Merton received the Alfred NobelMemorial Prize in Economic Sciences in 1997 for a new methodology to valuederivatives. He is past President of the American Finance Association, a memberof the National Academy of Sciences and a fellow of the American Academy ofArts and Sciences. He holds honorary degrees from eighteen universities. Merton’sresearch focuses on finance theory including lifecycle finance, optimalintertemporal portfolio selection, capital asset pricing, pricing of options,risky corporate debt, loan guarantees, and other complex derivative securities.He has also written on the operation and regulation of financial institutions.Merton’s current academic interests include financial innovation and dynamicsof institutional change, controlling the propagation of macro financial risk,and improving methods of measuring and managing sovereign risk. He is theauthor ofContinuous-Time Finance, and a co-author ofCasesin Financial Engineering: Applied Studies of Financial InnovationandTheGlobal Financial System: A Functional Perspective; Finance; and FinancialEconomics. Merton has also been recognized for translating finance scienceinto practice. He received the inaugural Financial Engineer of the Year Awardfrom the International Association of Financial Engineers in 1993,which also elected him a senior fellow.DerivativesStrategymagazine named him to its Derivatives Hall of Fame asdidRiskmagazine to its Risk Hall of Fame. He also receivedRisk’s Lifetime Achievement Award for contributions to the field of riskmanagement. A distinguished fellow of the Institute for Quantitative Researchin Finance (\'Q Group\') and a fellow of the Financial Management Association,Merton received the Nicholas Molodovsky Award from the CFA Institute. His firstprofessional association with a hedge fund came in 1968. His advisor at thetime,Paul Samuelson, broughthim on board Arbitrage Management Company (AMC), to join founderMichael Goodkinand chief executiveHarry Markowitz. AMC is the first known attempt atcomputerized arbitrage trading. After a successful run as a private hedge fund,AMC was sold to Stuart & Co. in 1971.In 1993, Merton co-founded a hedge fund,Long-Term CapitalManagement, which earned high returns for four years but later lost$4.6 billion in 1998 and was bailed out by a consortium of banks and closed outin early 2000.

|

Other Related Items:

Related Items:

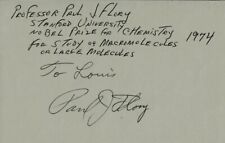

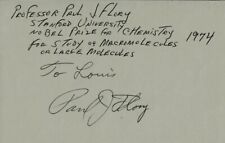

"Nobel Prize in Chemistry" Paul Flory Hand Signed Album Page COA $99.99

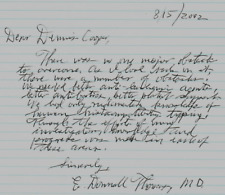

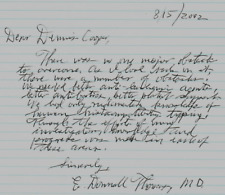

"Nobel Prize in Medicine" E Donnall Thomas Hand Written Letter COA $279.99

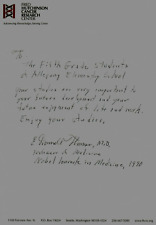

"Nobel Prize in Medicine" E. Donnall Thomas Hand Written Letter $279.99

|